Explanation of the Skew Analysis Report

using NYMEX Natural Gas (LN) options

The Skew Analysis Report is composed of several "blocks". We will quickly review what they are and how they might be interpreted. The report is composed of a title page plus a collection of plots. Finally, each report is capped with some notes and our disclaimer.

The Title Page

The title page has very basic description presented. It lays out the products which were used in the creation of the report. The user is specified. Additionally, details about model and calendar choices are also spelled out.

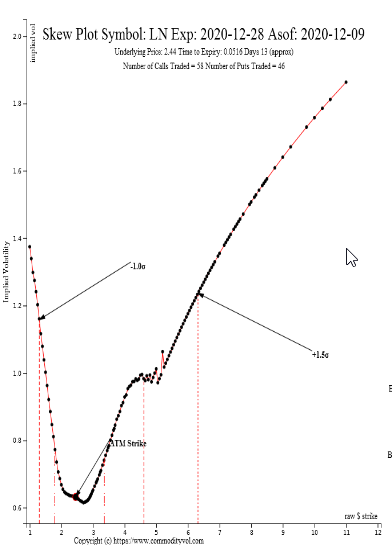

Top Block and Skew Plot

The top block of all three plots (per expiry) contains information that identifies the particular expiry, the number of days in the analysis, the exchange, the product and the performance of the underlying.

In this case, we see that this product trades on the NYMEX, is the product with symbol LN had a price of 2.44 on 12/9/2020 and expires on 12/28/2020.

Notice that the most extreme break points are labeled, with the remaining breakpoints shown by broken lines.

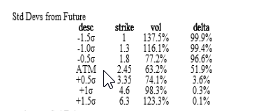

Standard Deviation Chart

This block takes the At-the-Money implied volatility and generates confidencebands around the current ATM strike. This is useful as it helps build a baseline around which moves in the market can be judged.

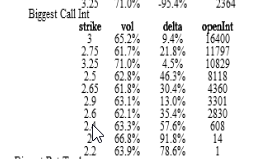

Call Open Interest

This block takes the call open interest and shows the top 10 strikes by open interest as well as the implied volatility at that strike. This gives a feel for where market participants are deployed.

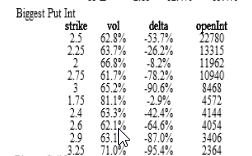

Put Open Interest

This block takes the put open interest and shows the top 10 strikes by open interest as well as the implied volatility at that strike.

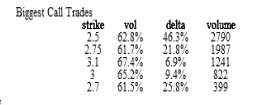

Actively Traded Call Strikes

This block lists the call strikes which exhibited the most traded volume. Again, the pace of trade and strikes trades can sometimes inform the observer where the market's new interest lays.

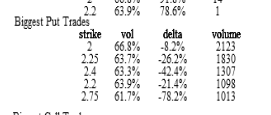

Actively Traded Put Strikes

This block lists the put strikes which exhibited the most traded volume. Again, the pace of trade and strikes trades can sometimes inform the observer where the market's new interest lays.