Month End Summary of Commodity Futures and Options

Welcome to our October 2024 Recap:

We are pleased to welcome you to our October 2024 month-end report.

What a month! Although we've been writing that a lot. Another hurricane down, more salvos back and forth in the Middle East, one election coming up but the markets are all about the `feelz,` as the youngster are apt to say. The corporate earnings and news are trickling out. Eli Lilly's price took a hit of Wegovy/Mounjaro after missing their sales numbers. Looks like Americans are going to stay pudgy and be proud about it. The sick man of aerospace, Boeing, is hitting capital markets for more capital. It isn't clear what in their capital structure was impeding their design, testing and building of jets, but like the drunk searching for his wallet under the streetlamp (instead of where he lost it), Boeing is going back to finance to right the ship. All good product stories begin in capital markets, right?

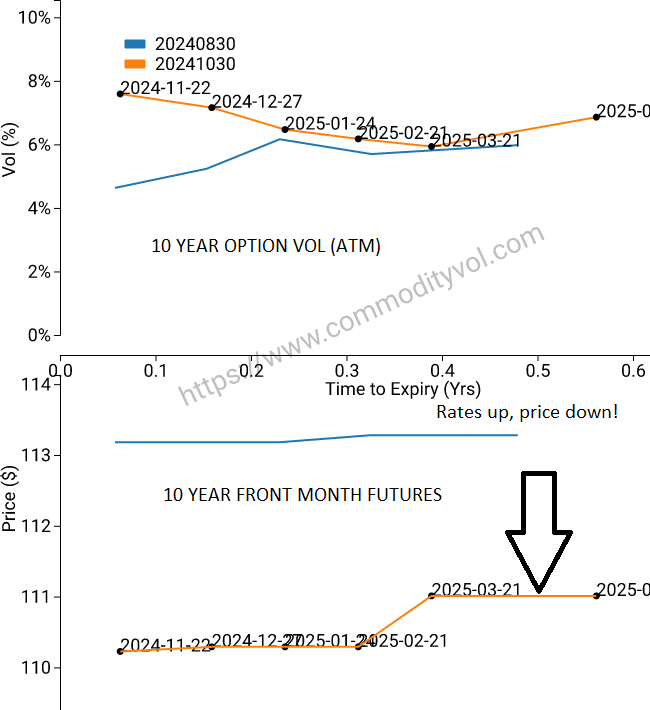

Talking heads are confused about the continued rise in government rates. It is chilling how journalists in capitalist systems forget that market participants also have a say in price determination (not just the government). The Fed is in a pickle. The Greenspan years saw the government move the duration of its borrowing closer to the short end of the curve. It was a wonderful ploy. The government rolled its longer term debt into shorter term debt, and got lower rates. Rinse and repeat. They had much more dollars they could squander.

Well, our spendthrift leaders are now discovering that financial alchemy has limits. The absolute monstrous size of the debt and its equally eye watering growth have finally made people come around to the idea that inflation is here to stay. We are not going over it. We are not going under it. We are going straight through it. With increasing inflationary expectations, the Fed cannot summon ersatz savings by buying Treasuries with conjured up money. This means rates will continue to be firm in order to lure whatever private capital still exists in the loanable funds market. The old 'crowding out theories' will get dusted off.

Perhaps the government will stave off the inevitable for a few more years, but even the mighty AI revolution isn't creating the broad bubble move like dot.com did. Sure NVidia is more richly overvalued than Cisco at its heights, but it is a very concentrated set of actors and scripts. In the late 90's it was a diverse set of companies and actors all in the mix.

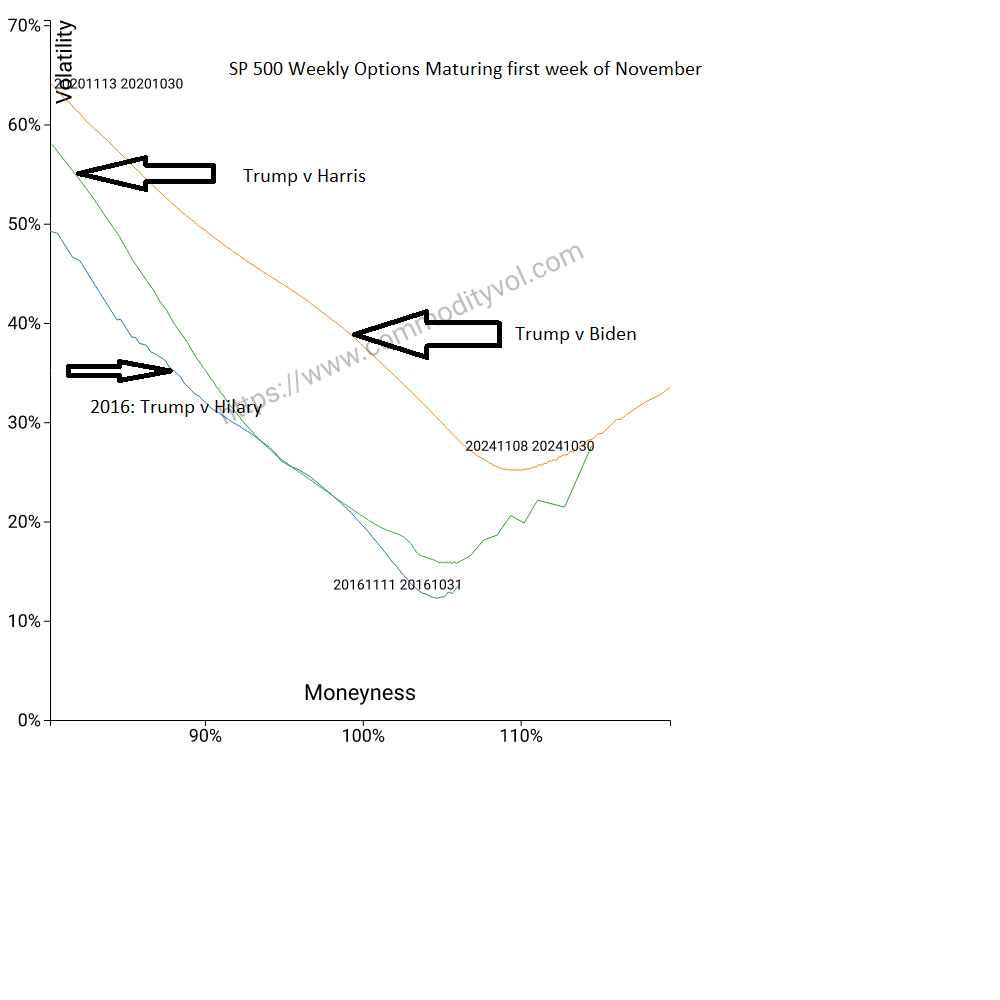

Considering that civilization might end after this election, you'd think professionals might express concern via options. The media tells us this is the most important election since the invention of democracy in Athens. The options markets might need to be woken up. Below are the weekly options expiring a couple of days after the election. Note that the markets are in the same mode as 2016. There is no concern as in 2020. We are hopeful that the pros recognize that the political theater is just as real as American professional wrestling.

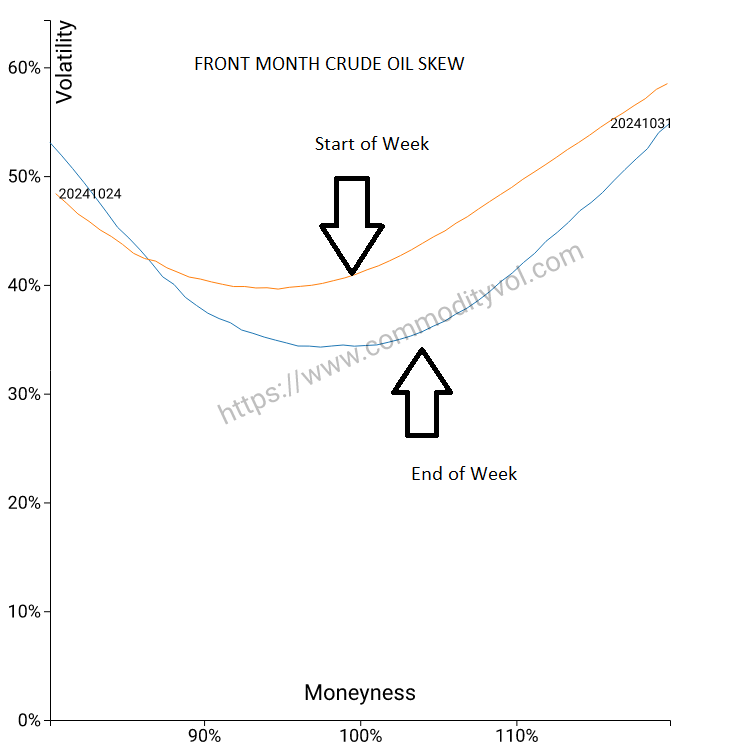

It is hard to say that risk premia exists in any market. For example, oil prices sold off aggressively after Israel's strike on Iran was deemed very `measured`. The disconnect, from our perspective, is that a measured response is not an end of the conflict. It may elicit a further response. There are all sorts of reason why one might want some risk premia built into energy markets. The empty US SPR is one of these reasons. A blocked Red Sea and potentially blocked Persian Gulf might be others. The power brokers have, so far, faced down these risks with nothing more than puffery, but the dam breaks one day. It always does. Below is front month crude oil skew. Notice that vol has sold off in droves. There was, a bit paradoxically, interest in puts.

We now proceed to our dive into the different market segments and our observations.

Forex

The story in the papers this month was all about the Dollar's strength. This is a loose statement since the dollar strength is more about the others' weakness. The futures price of every currency was down, with the exception of crypto. Everything else was on sale. The move in Bitcoin pushed it over $74,000. It is hard to keep up who is buying and who is dumping crypto. Ethereum tried to catch up. The move in vol across the board was impressive. Yes, most of the move was in the front month, and potentially related to US elections or expirations, but many pairs had moves that extended into the deferred months.

Foreign Exchange ATMBitcoin DetailEthereum DetailGBP DetailEuro DetailRates

Beyond our rant about the economic ignorance of most market commentators regarding interest rate determination, rates continued to climb, across the board. It would be tempting to say it is related to 'political risks', that would be wrong. Either candidate for president will balloon the debt further if their policies are enacted. There are no adults in the room as it pertains to debt, spending and government largesse. We are of the mind that the fall is inevitable, but that the US will kick the can 5-10 years further down the road. There is still a good bit of surplus that can be mulcted from the Europeans. There is a good bit of capital transfer to occur as, for example, European chemical producers relocate to the US Gulf Coast. As we alluded to in the beginning, the US debt load will put upward pressure on rates and there is nothing the Fed can or will do about that. The moves in the vol term structures across all products was impressive. The termstructures dramatically changed their slopes and convexities over one month.

Interest Rates ATM10 Year Detail30 Year DetailSOFR DetailEquity Indexes

Equity indexes continued their rally. The earnings news has been mostly okay. Yes, Super Micro, Eli Lilly, Boeing and others have surprised with very bad news, but the NVidia train keeps rolling. Much was made of the move in the VIX index over the month. The ATM vol in SP500 and NQ was, however, down. Again, both the weeklies (as discussed above) and the quarterly expiring contracts show a low level of expected risk in SP500. It isn't just the front month, the weakness runs the extent of the term. It is hard to believe the VIX has found some new vein of risk. Perhaps the VIX is picking up some change in the convexity of the SP500 skews that isn't readily apparent.

EquityIndex ATMSP500 DetailRussell DetailVIX DetailMetals

All that glitters is not gold, but gold is glittering! Silver is also strong. The winner was palladium. There was news that the US government was attempting to pursuade other governments to shun Russian palladium. The Russians seem to produce 40% of the world's supply of the silvery-gray metal. Aside from dental uses, the big use of the metal is in catalytic convertors. This set of sanctions will, no doubt, be as successful as the 13 or so that preceded it. That is, it will serve only to create short term confusion and pain for US consumers of the metal and in the long term, countries with good ties to Russia will see excellent trade in the metal and the products made with it. The problematic children were the industrial metals. Copper was widely discussed in the press. There is widespread feeling that the stimulus in China is a failure. Beyond the childishness of judging monetary and fiscal policy changes over a month's time scale, there is the confounding effect of stockpiling of the raw materials by the Chinese. As the world's biggest consumer of nickel and copper, China cannot afford disruption and had been on a stockpiling binge. There is a well know class of models in economics and inventory control call S-s, or echo models. In these types of models, applicable to purchases of large capital goods, a boom of trade triggers a bust and a faint echo with some lag. This is because it takes time to consume the asset, and once that consumption commences there is no need for further purchase. If the Chinese were concerned about a war limiting supplies of these inputs, then we should expect a lull in their activity until they have digested some part of the stock of copper.

Metals ATMGold DetailPlatinum DetailCopper DetailCopper Detail - LMENickel Detail - LMEAgs

Bumper crops seem to be the story in most markets. Corn in the US and Europe were both down. Vol went the same direction there. Wheat had the same story, down here and in Europe, though vol was stiff. Beans and meal were weak in the US, with oil showing some strength. Rapeseed was up in Europe. Hogs and cattle were up, but less than in the past few months. Lumber exhibited strength heading into winter in the US. Either the housing market is showing unwarranted strength or the weather suggests that the building season will stretch out a bit longer.

Ags ATMRapeseed-EuropeRough RiceCorn DetailSoybean DetailSoybean Meal DetailAgs DetailsEnergy

One hurricane and attack-counter attack later and the price of oil is down, with vol also coming down. Natural gas's price diminished, but vol was up. The persistent pattern has been to sell spikes in price and vol. There is very little carry through on these small panic moves. However, this is also not durable. The dam will break one day, the bad news will cumulate and then the long vol folks will look like geniuses. We believe that the weakness in global economic conditions (because of high borrowing costs, sanctions, policy failures, debts, lack of leadership) is acting as a buffer. There is no persistent spike because economic activity is anemic and smaller moves are absorbed via belt tightening by consumers. This is a temporary buffer for small moves. If trade ignites in the non-EU/NAFTA world, then the moves will have much more momentum.

Energy ATMUS Natty Gas DetailRBOB DetailHeating Oil DetailDetails EnergyAs always, we welcome you to visit our website and hope to help you manage risk!

CommodityVol.com is here to serve your needs around modeling, forecasting and understanding the market. If you have needs for commodity skews, parameterized surfaces (including stochastic volatility models), please do not hesitate to contact us! Contact Us