Month End Summary of Commodity Futures and Options

Welcome to our August 2024 Recap:

We are pleased to welcome you to our August 2024 month-end report.

In the shadow of the events of July, August seems like a vacation. The Democratic National Convention came and went with minimal issues in Chicago. This was a pleasant surprise. The other big event was the Fed's Jackson Hole meeting. Again, the 'market' was relieved, rate cuts were on the way! The shocker (to the chattering classes) was the horrific revision (downwards) in payrolls. Again, we were not surprised. Did we have any insight into what would happen-no. However, the tale of commodities has been woe and misery. It is hard to expect the economy to be popping given the anemic energy behavior and the somewhat muted movement in base metals. The interest rate story is one of nuances. The 'relief' in rate expectations will probably spur some activity. We must point out that there are still many financial companies sitting on billions of dollars in losses on Treasuries. These losses have not magically gone away. It is no surprise that everyone wants rates down. However, there are massive disruptions in trade due to all sorts of embargoes in connection to the RussoUkrainianNato conflict. Unlike previous recessions, there may not be a lot of non-inflationary spring back if or when the employment recovers. Heading into the fall, and the election, it will be interesting to see what shakes out. Either candidate has proposals which would be retardant to growth. On one side we have the prospect of increased capital gains taxes and new variations on capital gains taxation. The other side offers more tariffs on Chinese production. The gross public debt continues its moonshot trajectory. We are sure that the Martians will be buying and holding US debt next.

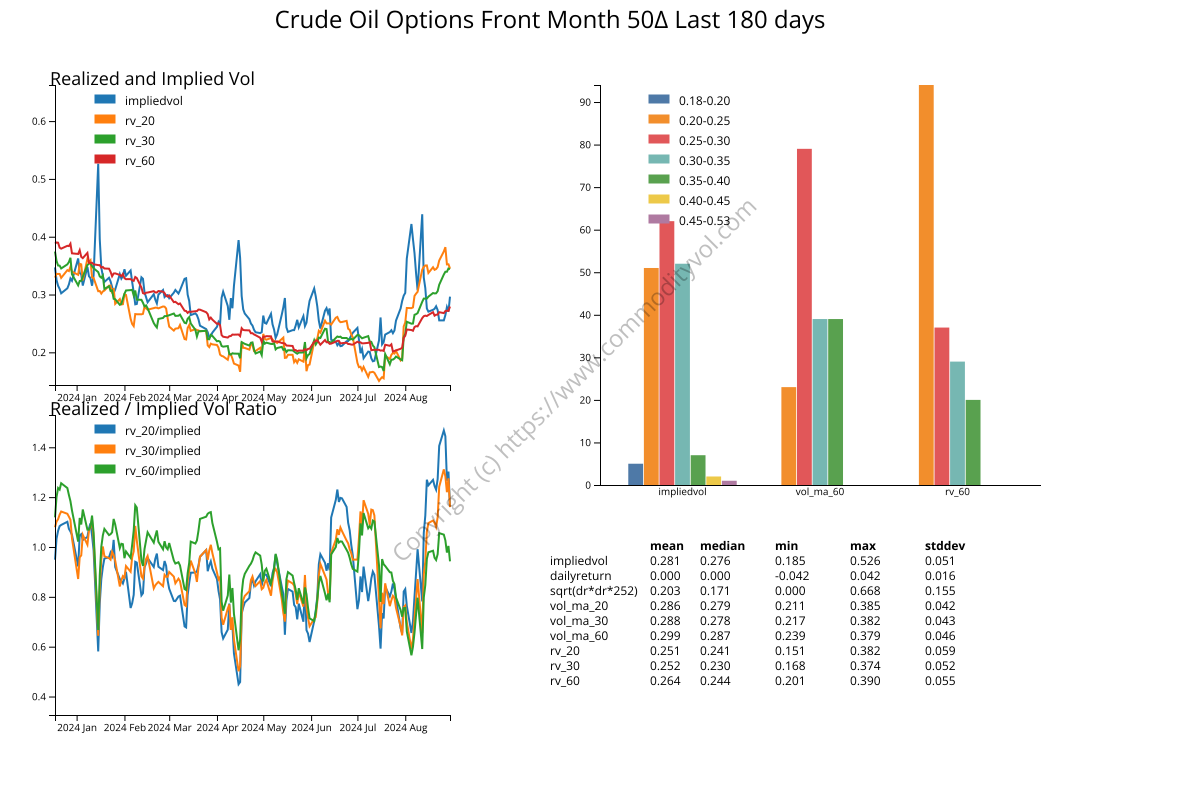

We started with crude last month and we pick up with it. The Houthi attacks on shipping continue unabated. Even with the increased frequency of attacks, oil is not concerned. Prices are low, much lower than we thought given world affairs. The correct trade has been to sell vol on pops. If we look at realized/implied statistics, the vol pop has come off. However, implied vol is rich in relation to realized. It is a few Bps, whether on an instantaneous or lagged basis. The recent volatility could be the signal the market needs for a regime switch, but thus far none of these events has been a catalyst.

Equities are in relief mode. The widely expected dovishness at Jackson Hole and the good numbers at NVIDIA have quieted concerns. The proposed unrealized capital gains tax did not affect markets much. Such a change would have a hard time passing a divided Congress. Much of the Baby Boomer wealth is in 401K plans. 401Ks would, most likely, be immune to the proposed taxation. It does stand to reason that a law to tax unrealized gains would increase the churn and volatility-especially in names and sectors which have been on long rallies, thereby putting pressure on the 401K. The muted response in equity markets suggests no one believes this to be credible.

The USDA released its crop report on the 26th. Corn and beans were above their averages and doing very well. Wheat and oats were showing some signs of trouble. Wheat and Oats both rallied, but Beans were down. There will be some drama around first frosts and harvests as we roll into fall in the Northern Hemisphere. Lumber, though not traditionally an ag, showed a massive rebound this month. It is interesting that the rebound came on higher vol. The disappointment in the home sales numbers must not have been as terrible as it would seem, or it could be a dead cat bounce. The meats are always a wild ride. Perhaps the USDA's cancellation of the cattle report fuels uncertainty. In the modern world, with satellite imagery and the AI everywhere, it is surprising that major new services haven't replaced that report with one of their own. The technology doesn't seem to get applied to solve real problems, merely to amplify a message or messages. Hog inventory is up, and the USDA instituted new rules around pork labeling. Perhaps this drove the fall in prices and rise in volatility.

The metals complex was volatile. As we've pointed out in the past, it is China, more than anything, which pushes the base and industrial metals around. There are major concerns around the Chinese real estate market, nickel (an ingredient for stainless and other specialty alloys production) was up. Palladium, silver and gold were all stronger. Copper was up both at the COMEX and LME. Nickel, copper and hot rolled steel showed increases in volatility. It is hard to divine what parts of the China story are true and what is jawboning by the pro and anti-China camps.

The cryptos took the prize for wild moves. Vol was up strongly for the cryptos. Oddly enough, vol was incredibly strong for every pair, except the Yen-Dollar rate. Perhaps this is the rest of the market catching up with the fireworks from a month or so ago. The travails in Europe seem to continue. Whether it is the German elections or Macron's position in France, the political picture is changing dramatically. The AFD's success in Germany is sure to put pressure on German policy. Anyone mentioning German deindustrialization 24 months ago would have been derided as a Kremlin propagandist. A simple google news search shows more and more mainstream publications writing about it. Again, if the US elects Trump, whatever remains of the old guard in Europe (Macron and Scholz) will find itself in an interesting position. They will be put down by the US and fighting against their own people. It will be interesting!

The push for cheaper credit reached a crescendo. One can only imagine what would have happened had the Fed's Powell been a little more coy about moving towards an accommodative policy. The reality is that too much depends on cheap credit. The US debt issuance is astronomical. Someone has to pick up that issuance via forced savings. Too many financial institutions hold very underwater US Gov't bond positions. There is nothing historically extreme about the magnitude of the interest rates in the US. What is extreme is the relative and absolute size of the federal debt. It has always been our view that inflation must rise. It will erode the debt and allow the stealth taxation that is necessary to fund this largesse. The news of the dovish stance of the Fed drove Treasury futures up. Vol was a mixed bag, we'll call it unchanged.

We now proceed to our dive into the different market segments and our observations.

Forex

The Yen move in vol was the most sedate in the bunch. The Euro moved dramatically at the front end of the curve. Perhaps this is the result of the elections in France and the regional elections in Germany. Our belief has been that the cartel of OECD central banks has carefully coordinated their actions so as not to create FX turmoil. Perhaps this is the sign that the dam is breaking. If one of the groups starts a 'beggar thy neighbor policy' of weakening its exchange rate, then it can quickly become a race to the bottom. Politicians love to rail against the exchange rate being too rich. Export businesses also benefit from a weak currency. It fits the mold of the modern politician-deal with the symptoms and never the problem.

Foreign Exchange ATMBitcoin DetailEthereum DetailYen DetailEuro DetailRates

Futures were up across the board this month-just like last month. Lower discount rates and open market purchases will bring rates down to some extent, but it cannot compete with the gargantuan and growing federal issuance. Riding the edge between accelerating inflation and failed auctions will be epic. People should enjoy this respite from CPI/PPI. It is our view that we are near closing time and the bar tab will be paid, one way or another.

Interest Rates ATM10 Year Detail30 Year DetailSOFR DetailEquity Indexes

NVIDIA, Ozempic and Wegovy-the three pillars of investor fascination and the Jackson Hole dispatch have succeeded in keeping the levitation going. After the brief spike in vol in the wake of the Trump assassination attempt, vol has steadfastly come off. The election looms large in the public's mind, but the investing public seems to be unconcerned. The sell off in SP500 vol was heavily concentrated at the front, but it carried though all across the curve. The VIX is also very anemic-again not terribly surprising given the prevailing confidence.

EquityIndex ATMSP500 DetailRussell DetailVIX DetailMetals

Gold seems to be quiet this month. Platinum back month vol was bid aggressively. This stands out as the other metals were mostly quiet. COMEX copper is showing an interesting bid in March/April 2025, but offered in the really long end of the termstructure. LME copper is showing a bid across the board, in vol and prices. The backend of the HRO Steel vol termstructure showed quite a bit of strength. Lead at the LME showed quite a strong bid across the board in vol.

Metals ATMGold DetailPlatinum DetailCopper DetailCopper Detail - LMEAgs

Corn vol in the US was smashed at the front. The bid in price was solid, and across the board, but vol moved much more dramatically. Perhaps the crop is in a good spot and there isn't much that could imperil the harvest. Beans also exhibited a sharp sell off in vols at the front of the curve. European rapeseed showed a bid in vol.

Ags ATMRapeseed-EuropeRough RiceCorn DetailSoybean DetailAgs DetailsEnergy

The energy picture is mostly lackluster. As we stand at the end of summer, the heating oil market is very weak. The prices fell and vol was unchanged, mostly. The front end of the RBOB volatility term structure showed an impressive bid. This comes on a massive drop in prices. Perhaps this is confirming evidence of reduced economic activity.

Energy ATMUS Natty Gas DetailRBOB DetailHeating Oil DetailDetails EnergyAs always, we welcome you to visit our website and hope to help you manage risk!

CommodityVol.com is here to serve your needs around modeling, forecasting and understanding the market. If you have needs for commodity skews, parameterized surfaces (including stochastic volatility models), please do not hesitate to contact us! Contact Us