Month End Summary of Commodity Futures and Options

Welcome to our September 2024 Recap:

We are pleased to welcome you to our September 2024 month-end report.

What a month! The Gulf coast survived Hurricane Helene. The mainstream news media has been holding its breathe waiting for all the storms that were predicted at the beginning of this storm season. While, there is still about a month or so left in the season, the number of named storms is much, much lower than expected. While natural gas exhibited a bid over the last week, it is hard to see much of lasting effect https://www.commodityvol.com/permalink/permshort?pay=Q1Q1I0GTrTywPrMoctoN

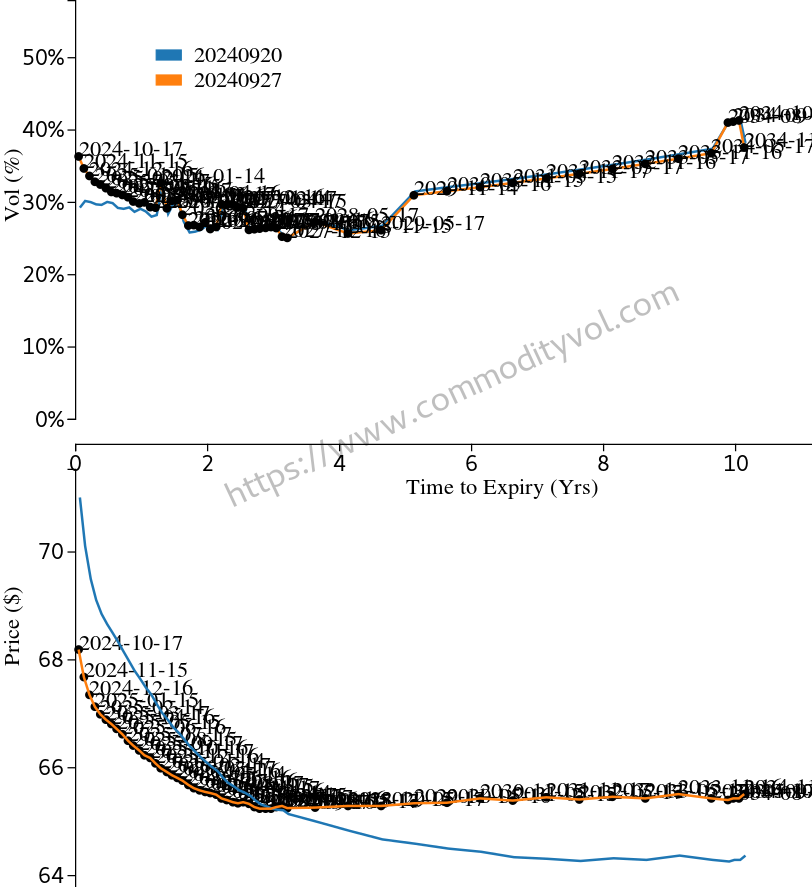

In addition to the Gulf storms, there were major escalations in the Mideast War(s). We keep scratching our heads wondering where the uncertainty disappears to. Here is the term structure of oil https://www.commodityvol.com/permalink/permshort?pay=Q1Q14kmxZrEThlFZcflG

There is nothing to suggest any real concern in volatility markets. This is surprising. We read news accounts of metal stockpiling and hoarding in preparation for US-Chinese hostilities, but the Strategic Petroleum Reserve is down to fumes. It suggests some sort of concerted effort to disparage hydrocarbons as an energy source, or perhaps naive overestimation of the ability of US shale to be pressed in as a swing producer.

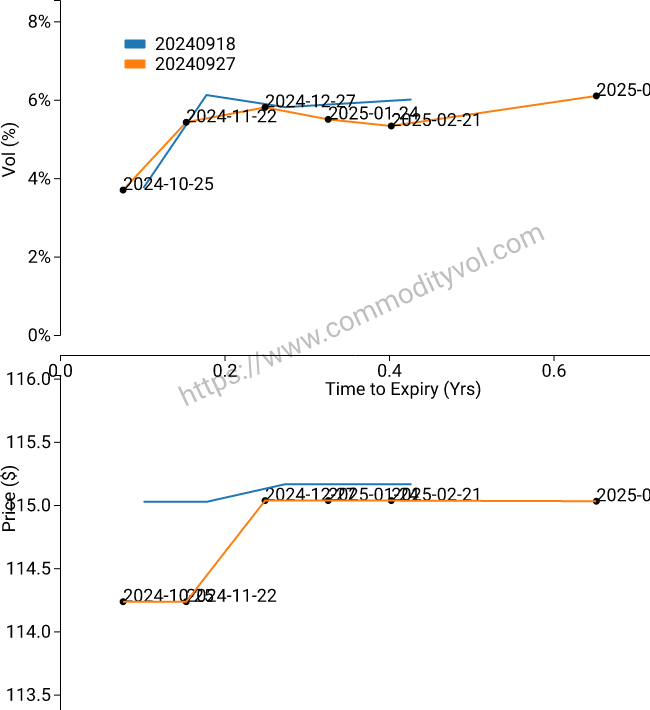

Equities are in relief mode, it seems everyone got their wished for 50 Bps rate cut. The cut was more anticipated than the suicide of Socrates. The problem for the 'rate cuts leads to stronger housing argument' is that the 10 Year futures fell in the aftermath of the cut. In other words, the 10 Year rates went up!? https://www.commodityvol.com/permalink/permshort?pay=Q1Q190Mxy4KQ2HnQGsCX

Not to be outdone, the Chinese opened the credit spigots as well. This ignited a massive pop in their equities. It will be interesting to see which side cheapens their currency more aggressively, the US or China. If cheapening your currency was the path to success and prosperity, Zimbabwe or breakup Yugoslavia would be heaven on Earth. It is hardly of vote of confidence in the world economy when the two biggest economies need to resort to Third World policies to ignite growth.

The USDA published its forecast for farm incomes. https://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances/highlights-from-the-farm-income-forecast/ The forecasts are for lower incomes overall. Over this past month, however, prices were mostly up. Both European and American corn was up strong-despite the good weather. Cattle were strong, pricewise, both feeder and live cattle. Soybean meal was up dramatically. Vol was dramatically down in cattle and hogs. Oats, beans and meal showed strong bids in vol. Lumber vol was offered. It may be a reaction to the rate cut, or the seasonal reduction in demand for lumber.

The metals complex was strong across the board. This would be consistent with the monetary taps being turned on. Of the entire complex we cover, only the specialty aluminum was done this month. Between the US stimulus and the Chinese stimulus, we would expect that this would go on for some time. The other issue is the perceived need to stockpile metals as, presumably, the major powers prepare for war. We will know when the stockpiles are full by the disengagement of prices and vols from the underlying economic dynamics.

The cryptos took the prize for wild moves, again this month. Vol was down for both. The dollar was weaker against all the currencies in the panel we follow. However, that fact hides some things in the weeds. Like last month, the market isn't appreciating the political changes in Europe. While Scholz and company were in New York for the UN meetings, the Austrian Freedom Party rocked the elections. As we pointed out, neither Macron nor Scholz is on solid ground. The conflict in the Ukraine is bringing a bitter harvest to the politicians who expected a Russian collapse. They are still buying Russian gas, now marked up. A quick google news search for `german deindustrialization` yields a trove of articles from outlets like Bloomberg. What effect that will have on forex isn't clear. Both the US and Europe will have to compete on currency to combat the relative inefficiency of their economies to the Asian ones. It should be bullish for straddles and strangles.

The Fed was the center of attention in trading markets this month. Futures were up across the board, with the biggest moves at the front of the curve. However, as we pointed out in our preamble, the move in the 10 Year after the decision was up in the rate (down in price term). The move deflated short term uncertainty from rates, so vol came off. Potentially, there are complicating factors coming up. If the port/dock strikes occur on the eve of the election, there might be the possibility of a surprise 25 bps cut. Everything about the Greenspan (and onward) Fed has been about politics and appearances. Even though such a move is unlikely to have any real effect, it fits the mold of modern Fed decision making.

We now proceed to our dive into the different market segments and our observations.

Forex

What is interesting this month is the pattern of movement in EUR and GBP markets. In both cases, vol started strong, faded and then rallied beyond its starting point. The gray lines on the time series plots give the path of the termstructure through the month. Yes, the big part of the move was in the front end of the curve, but there was still plenty of move in the back months. There the obscene moves in AUS/USD vols, but it isn't clear what happened. Crypto vol was unusually tight throughout the month.

Foreign Exchange ATMBitcoin DetailEthereum DetailGBP DetailEuro DetailRates

Futures were up across the board this month-just like last month (and the prior one). As discussed above, vol was down across the board and across the term. This euphoria will last to the extent that employment shows growth (and no revisions) and inflation does not make an unscheduled appearance.

Interest Rates ATM10 Year Detail30 Year DetailSOFR DetailEquity Indexes

Beyond the beaten to death interest rate move, this month ended up with major US indexes up. Vol was down across the board. There's not much to say except that heading into a very divisive election, there might be some reason to expect elevated volatility. The other major occurrence this month was the release of Apple's latest device. AAPL is less of the darling that it used to be, so the pop from its pronouncements has faded quickly. Earnings season seems to have mostly hit expectations. There were very few shockers.

EquityIndex ATMSP500 DetailRussell DetailVIX DetailMetals

It is hard to pick out standout metals this month. The story is very similar to whichever metal one looks at. Prices were strong, and vol was strong. The bid in vol extended the length of the expiry term. If one looks at copper, there is the telltale sign of a call bid rally. Nickel was an example of volatility being offered.

Metals ATMGold DetailPlatinum DetailCopper DetailCopper Detail - LMENickel Detail - LMEAgs

Soybeans and meal had a clear bid in the entire front part of the curve. There was good interest in the calls. Perhaps this is a consequence of the Chinese stimulus? Then there are the relatively dry conditions in Brazil. Wheat vol was offered at the front. The entire front month skew sold off. Lean hogs and live cattle both sold off front month vol, but cattle was offered all along the curve. Prices were good for the meats.

Ags ATMRapeseed-EuropeRough RiceCorn DetailSoybean DetailSoybean Meal DetailAgs DetailsEnergy

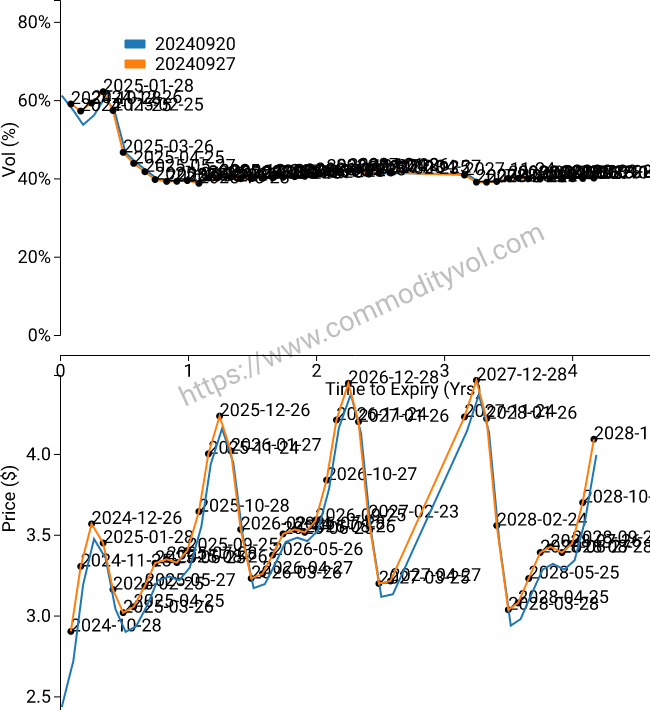

Energy has eclipsed equity indexes as hard to understand. In the face of major escalations in geopolitics and war risk, the price of oil is down. Again, there is probably some good degree of elasticity of supply, but there can't be that much. Vol was up in crude, but only at the very front of the curve. Much of the back was sold off. Heating oil futures sold off with no change in vol. Natural gas prices were up about 30%, but vol sold off. The Atlantic/Gulf storm season is nearing its end. However, there is still a month or so of hurricane season. The late season storms are typically quite destructive. Perhaps premium buyers were burned by the gloom and doom forecasts of a huge number of storms that never materialized. Like the townsfolk in the story about the boy that cried wolf too many times, the hedgers decided to sit on their hands.

Energy ATMUS Natty Gas DetailRBOB DetailHeating Oil DetailDetails EnergyAs always, we welcome you to visit our website and hope to help you manage risk!

CommodityVol.com is here to serve your needs around modeling, forecasting and understanding the market. If you have needs for commodity skews, parameterized surfaces (including stochastic volatility models), please do not hesitate to contact us! Contact Us