Month End Summary of Commodity Futures and Options

Welcome to our June 2024 Recap:

We are pleased to welcome you to our June 2024 month-end report.

Political theater took center stage near the end of the month. It was a debate which will live in infamy. Depending on your political leanings, either you felt vindication or shock. Our view is that CNN should have had a slaughter rule and called the debate early.

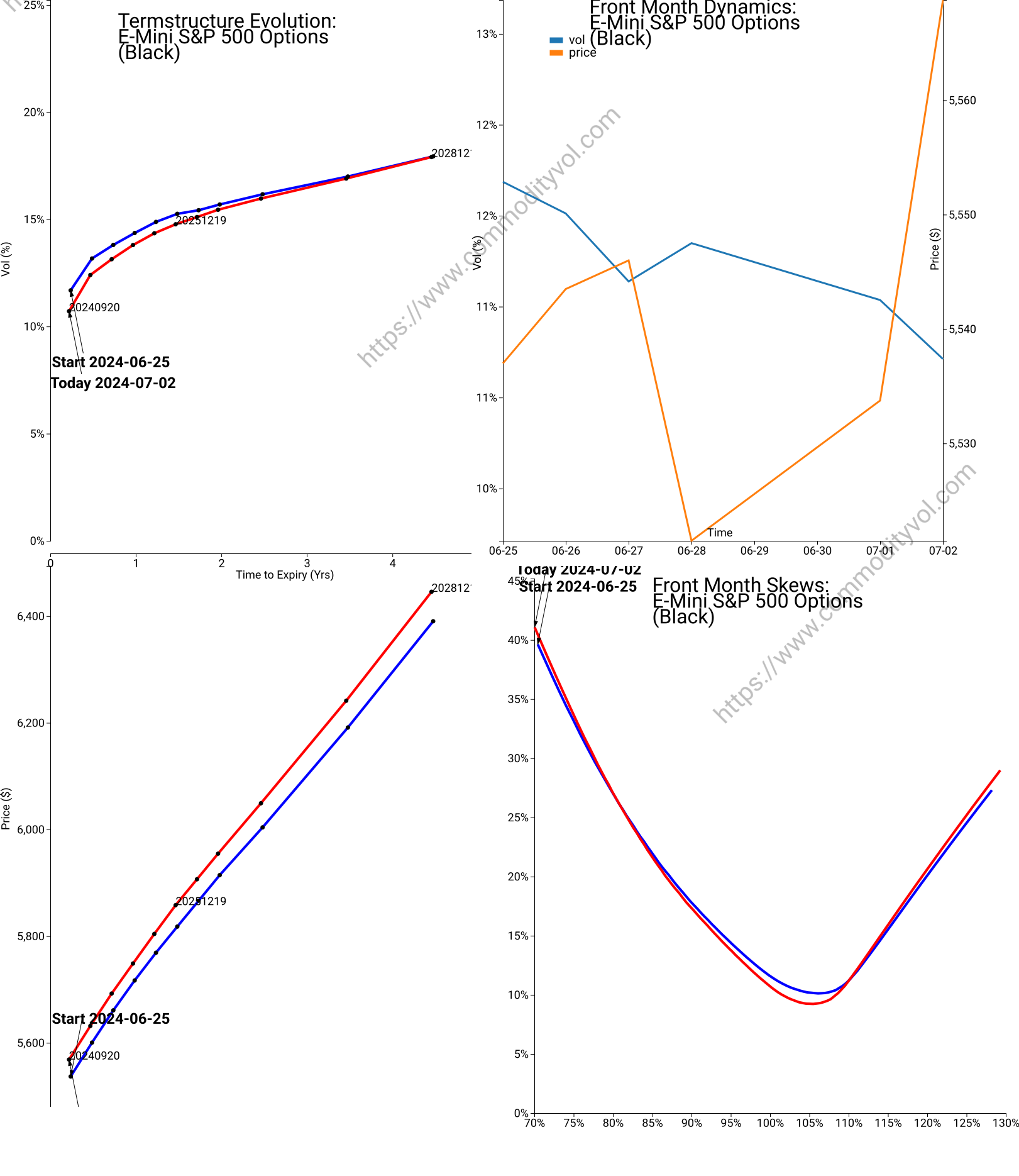

We were not surprised by the performance. What is surprising is the lack of response by markets. Attached below is a picture of the SP500 volatility and futures price. You'll notice the conspicuous lack of movement in vols.

This post COVID regime in vols is consistent with the long COVID syndrome described by many in humans. Whether it is equity index futures, commodities or metals, things seem anemic and lack any conviction. While the chattering masses like visible stability, this is disconcerting for the professional. A weak US political process means assertive adversaries abroad. A weak US political process cannot be good for the dollar's reserve status. Perhaps, the market recognizes that a lot cannot change if either candidate or an unknown, third, is elected. The largely unelected US government's clerical and administrative system will survive any overt political crisis. Perhaps this is the Black Swan. We all believe that things cannot change because all policymakers, business heads and thought leaders have grown up in a world of unfettered US hegemony ('End of History'). The political, social and business leaders see no other possibility in the short run, they are probably correct. I am not sure history or the rest of the world sees things this way (at least longer term). Perhaps therein is the resolution for vol not showing any signs of panic-nothing can be done. This risk is unhedgeable, so just like the possibility of an asteroid collision causing SP500 to drop to 0, there would be no one to collect from. The risk doesn't matter. When you've excluded all other possibilities, that which remains must be the explanation. No one cares because the slide will be incredible and permanent. AAA ratings will not matter-as was evident in 2008. We hope that we've missed a possibility, perhaps a technological breakthrough.

The first cracks in the facade of real estate are beginning to manifest themselves. There are more and more reports of commercial office space selling for less than 70% of the last sale price. There are reports that even white hot markets are seeing growing unsold residential real estate inventory. Lumber is down. Vol is up slightly. For sure, one sees the splashy news about Blackrock initiating a new fund to purchase rental property. We've seen their acumen on 'Green Investing', ESG and so forth, and expect a similar performance in real estate. Real estate is hard-that's why it remains an elusively local affair. Laws around handling tenants are, by their nature, county based and often common law. Where there is codification of tenant's rights, the codes are a patchwork. We will watch in amusement as these firms discover evicting a family in Tupelo might not be as simple as their NYC based law firm told them it would be. Let us also avoid mentioning the fact that most eviction processes can be lengthened through the American 'pro se' or small claims courts. The fund's $2000/hour lawyers will be in court fighting requests for continuances by anyone who can pay the filling fee. It will take only a few social activists to turn evictions into a major political scandal. We've got the popcorn ready for this spectacle (especially since corn is a bit weak).

The drumbeat of discount rate cuts is making the rounds again. The consensus view one year ago was that we'd be in the midst of an easing cycle again, presumably to 0% rates. The reality is we are still talking about this. The CPI remains high. People are also discussing the fact that even a CPI of 0 does not return price levels to those a mere 3 years ago. Americans like to relearn basic truths about the differences between levels and rates of change. However the CPI is defined or redefined, it has become a stylized fact that essentials are much more expensive-beyond mere stealthflation (smaller amounts being sold in identical packaging). It is our thought that once summoned, the inflation genie will not go easily back into the bottle. There are the pure monetary effects of conjuring trillions of dollars of PPE and support checks out of thin air, deficit spending and gifts to foreign countries. There are also probably lasting issues from the COVID shut downs. Complex systems do not suffer shut downs well. This is true for power grids, see https://www.texastribune.org/2021/02/18/texas-power-outages-ercot/ and any complicated network. One only need to look at Raytheon hiring retirees https://www.defenseone.com/business/2023/06/raytheon-calls-retirees-help-restart-stinger-missile-production/388067/ to realize that a lot of the knowledge in economic systems is not documented, but embodied in the workers. COVID and the foolish knee-jerk response (firings and mandates) has destroyed the very people that were critical to many subsystems.

The oil patch shows rising prices, both in WTI and Brent. The entire crude related complex showed a bid of 7 to 10%. Vol was quite anemic. Natural gas dropped in price and vol. This is even though forecasters have been talking up the super storm which will hit the Gulf. We grow tired of repeating that there are two major wars going on. The war in the Ukraine still continues to serve as a spark for a global conflagration. The Russians seem to have turned a corner economically and diplomatically. Mr Putin was the guest in North Korean and Vietnam. His partnership with Xi is flourishing. US pleas to Xi to limit their association with Russia are ignored. The limited war in the Levant looks like it will be growing as well. The Houthis, far from being cowed by the US and NATO, seem to be operating with impunity and inviting increased Somali pirate activity. How this isn't a case for global risk premia to be increasing is a mystery.

Equity indexes continued their ascent to new heights. We referenced the hackneyed argument that cuts in interest rates boost equity prices because the future earnings become more valuable. We wonder why equities didn't go down in this tightening round. It is a levitation. The story stocks dominate the news flow. Whether it is the goings on of the Roaring Kitty character, AI or weightloss in a pill (or injection), the financial media is critical to keeping the levitation going. People are talking about the possibility of another down turn, but finding Ms Yellen shopping (out in the wild) is the scoop of the day. Perhaps the stock market has become the new third rail of American policy. Too many pensions and private 401Ks have exposure to US equity markets that the government would not allow a major correction. It would destroy confidence and require infusions to pensions to keep them solvent. It was common practice (in the 1990s) for pensions to revise their expected returns from 6% to 8%, with a stroke of a pen many underfunded pensions became fully funded. We wonder if any pension would be solvent assuming 4% total return on bonds and 6% total return on equities. It might explain the rally in equities whether rates go up or down, war is imminent or canceled, or your sitting President is a felon or demented.

Ags, as usual, were a mixed bag. Corn, was down in the US and Europe. Wheat was also down in both Europe and the US. Soybeans were down dramatically as well, while rapeseed was down slightly in Europe. Lean hogs were down, while cattle was up. On the implied volatility side, corn, hogs and lumber showed big percentage increases. Cattle, wheat and rice showed massive declines. The weather will drive these prices for the foreseeable future as rain determine yields.

With the exception of palladium and tin, metals were down across the board. Vol was down dramatically in most products with the exception of aluminum, tin and hot rolled steel. Perhaps this is seasonal weakness as the Northern Hemisphere is in summer mode or perhaps the demand just isn't there.

The dollar was stronger (!) against all pairs. Vol was down across the board, except against the Euro and the Mexican Peso. The Yen fireworks earlier this year have abated.

We now proceed to our dive into the different market segments and our observations.

Forex

The Euro moves were awesome. It isn't clear what beyond the obvious has reared its head in Europe. The spendthrift traits of the French or Italian government hasn't changed. Perhaps it is the increasing political instability in Paris and Berlin that is causing these spikes in vol. Oddly enough, Great Britain, facing political and budgetary upheaval, was the model of certainty and quietude. The Peso move seems to be more thin markets than any real move. The cryptos are showing weak upfront vol and higher deferred vols.

Foreign Exchange ATMBitcoin DetailEthereum DetailEuro DetailPeso DetailRates

Futures were up across the board this month. The futures options showed strong bids in front month skews. Yes, the expectations are for rate cuts, but the uncertainty increases.

Interest Rates ATM10 Year Detail30 Year DetailSOFR DetailEquity Indexes

Equity indexes got their act together this month. They were up in lock step. The Nasdaq led the way, but Russell was no slouch. Vol took it on the chin (as usual). It will be interesting to see a vol bid over a couple of months. The world might have to end for that to occur. We are back at the low teens vol for the SP500, with the low point of the curve breaking below 10%. This is a remarkable testament to the effect of easy money. Neither wars nor dysfunctionality in politics has any effect on fear. As we've highlighted in previous posts, it isn't just the fear gauges (VIX or SP500 skew), it is the lack of realized vol. The mania that pushes vol above 20% needs to have kindling, and there is none in these markets.

EquityIndex ATMSP500 DetailRussell DetailVIX DetailMetals

Metals were all up, with the exception of Palladium and Hot Rolled Steel. Obviously, the biggest mover was the Aluminum contract. Platinum, Silver and Tin were also up significantly. In terms of vol, Platinum, Silver and Tin were up dramatically. The caution in the vol markets for some of the LME contracts is that their activity can vary and so not all skews seem to have a complete and dense number of strikes.

Metals ATMGold DetailPalladium DetailCopper DetailCopper Detail - LMEAgs

In the ags sector, there were a lot of big moves. European corn (maize) was up dramatically, while US corn was down slightly. Vol was very strong in both. Feeder cattle rallied on unchanged vol. Live cattle and hogs were up dramatically on unchanged vols. Wheat rallied in both the US and Europe, as well as between the CBOT Wheat and Hard Read Wheat. Vol was screaming across the board in that product. Beans and rapeseed were up strongly, with meal and oil up even more so.

Ags ATMFeeder Cattle DetailTimberCorn DetailSoybean DetailAgs DetailsEnergy

Oil, whether Brent or WTI, had a weaker month. The Houthi blockade of Red Sea traffic continues unabated. Perhaps as we get closer to the winter storage season, the effect of the higher cost and more uncertain shipping will manifest itself. Vol was up slightly. Natural gas seems to have found some legs. We speculate that the opening of the Freeport loading terminal and it running at capacity is the reason for this. Natty was up 0.65. Vol was up small. The pressure on vol has been decidedly lower. We are in the thick of the storm season in the Gulf Coast of the US. It is only a matter of time until vol starts to react to hurricane forecasts.

Energy ATMUS Natty Gas DetailWTI Crude DetailDetails EnergyAs always, we welcome you to visit our website and hope to help you manage risk!

CommodityVol.com is here to serve your needs around modeling, forecasting and understanding the market. If you have needs for commodity skews, parameterized surfaces (including stochastic volatility models), please do not hesitate to contact us! Contact Us