Month End Summary of Commodity Futures and Options

Welcome to our July 2024 Recap:

We are pleased to welcome you to our July 2024 month-end report.

What a glorious time to be alive! Let's recount the ways these past few weeks have proven Lenin's remark that '... in some weeks, decades happen'. Where does one begin? Obviously, the attempt on former President Trump's life started the month off with a bang. Then we had the drama of whether the sitting President would continue in office. We had the continuous hemming and hawing over interest rate policies. Finally, we witnessed acceleration in the Middle East fighting.

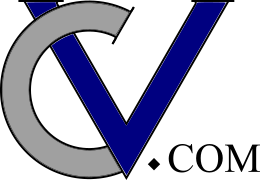

Let's take the oil implications first. Here is the 20 day history of realized and implied vols, with some other statistics. The spike is impressive. Implied vol seems to be leading realized. The market is working as the textbook would suggest.

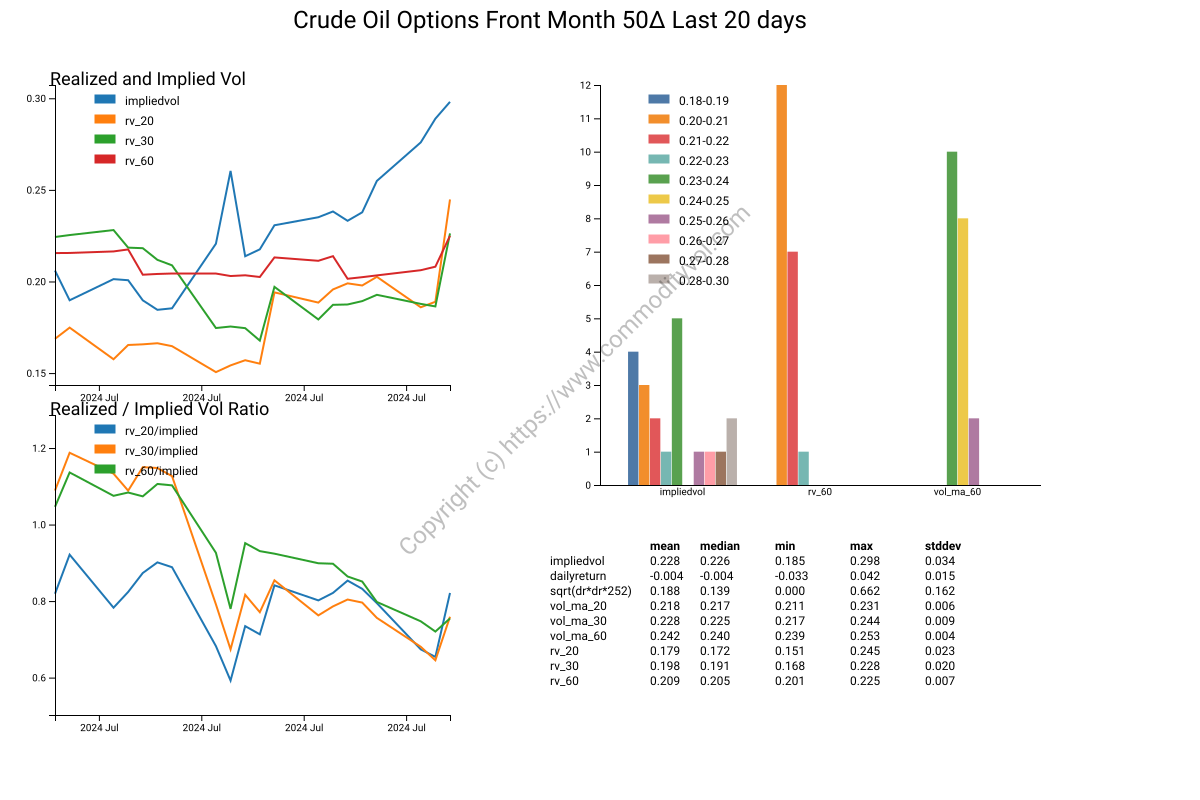

On a longer time scale, the spike is less impressive. The prevailing trend has been a persistent grind down in volatility.

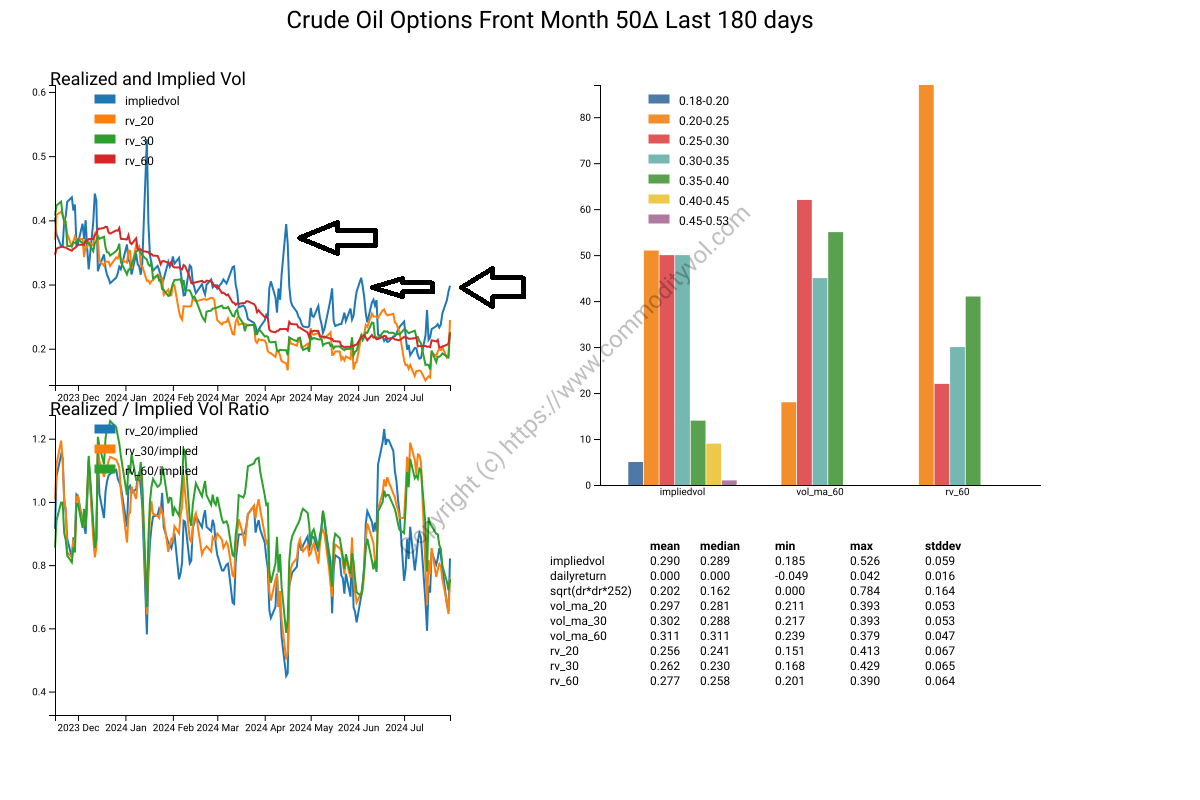

Going back to the Trump assassination attempt, we also see a similar pattern in index vols. The spike in implieds has led the realized vol. In the case of SP500, it has been range bound for so long, that the spike might be serious for investors who may be used to less overall uncertainty. Risk parity portfolios generate a lot of hedging when the expected risk of a class changes. Again, time will tell in the case of both oil or equity indexes where vols will end up. The risks are real in both cases. A wider war should goose oil prices and raise uncertainty, depressing economic prospects. The X-factor is the election year. It is an open secret that monetary taps are turned up during election years. This crude instrument (the credit fountain) has beaten back any attempt at reality asserting itself since 2008.

The flash in oil markets at the end of the month might lead you to believe that there is strength in that market. This is not true. The spike in the last day (of the month) only managed to staunch some losses. Both WTI and Brent were down on the month. WTI displayed a 560Bps increase in ATM vols. Natural gas has also not found its footing. The prices are in the doldrums. There is a lot of back and forth over what is to blame. Is it weak demand? Is it too many wells? A failure of the Freeport terminal to finally monetize the US/Europe spread? The first Atlantic storm came and went. Vol is up on the presumption of an active storm season causing trouble, but just as in oil, the prevailing trend is down, down down!

Equities are in earnings release mode. The AI gold leaf might be starting to tarnish. There are more stories of large companies abandoning AI enhanced products. OpenAI is facing troubles around its cash burn. Meta has opensourced some models they've calibrated. The Nasdaq futures lost about 2.7% and vol was up 420Bps. It isn't volmageddon, but we'll take it. Russell ended up on the month. Its vol was also up significantly. For all of the fireworks, SP500 was almost unchanged, with a vol boost of 260Bps. The VIX was up about 4 index points. Again, this is not barn burning, but a bit of ripple before the election.

Ags are always a mixed bag, a cornucopia of uncertainty. While not strictly, an ag, lumber was up. The proteins were all up on mostly reducing vol. The grains and oilseed were all down. Corn in the US and Europe were down 6 and 2.4%, respectively, with vol down. Rapeseed was down in Europe. Beans were down in the US on stiff vol. Rough Rice showed the only exciting vol move. This is not a heavily traded product.

Aluminum and gold were the standouts during the month. Gold is most likely rallying (or revaluing) on the growing awareness of the unsustainability of the US public debt. A 220Bp move in its vol is steep. What hasn't occurred is follow through in the other precious metals, silver in particular. The only signs of something happening is silver's vol popping as well. For all of the press articles talking about Chinese stockpiling of raw materials, there isn't evidence of this in copper, lead, tin or nickel.

Forex was relatively quiet. The dollar was up against the Aussie, Peso and the New Zealand Dollar. The Yen was somehow up. Its vol is stirring again. If there is a Black Swan flapping its wings out in the air, it has to be an implosion of the Japanese economy. One wonders what rocks will emerge when the tsunami of cheap money recedes. Crypto was unusually quiet this month.

Rates are back into rally mode. In the fixed income market's 'Peace in Our Time' mentality, most pundits expect a rate decrease. Futures were up across the board. Vol was offered on the Bond and Ultra contract, while it was a slight bit closer on the expiry term.

We now proceed to our dive into the different market segments and our observations.

Forex

The Yen move in vol (and price termstructure) is awe inspiring. Not only did the front month volatility curve move up, but it looks like it picked up call skew, maybe this is normal or the effect of small out of the money option trades. The Swiss Franc is also showing very hard moves. This could be as simple as a bifurcation and the eventual break up of the cartel like coordination between central banks, especially after 2008. Time will tell!

Foreign Exchange ATMBitcoin DetailEthereum DetailYen DetailSwiss Franc DetailRates

Futures were up across the board this month. The party line is that rate cuts are coming. Again, we must question the sanity of anyone who believes a 25Bp cut in a target for a rate that only large money center banks borrow at will make any sort of difference. It also ignores the presumably unsterilized bond purchases that will be required to prevent bond auction failures. Further ignored are the trillions still bouncing around the system from the 2008 bailouts and the COVID shenanigans. Fred still shows the balance sheet greater than 7 trillion (https://fred.stlouisfed.org/series/RESPPANWW). Salvation will be driven by getting those 25Bps sooner.

Interest Rates ATM10 Year Detail30 Year DetailSOFR DetailEquity Indexes

The movement in vol for the equity indexes is almost mechanical. The skews all shifted upwards, but no major washouts. The same day market is still there, but people seem to be talking less about it. Perhaps, the traditional short premium players are in that market more than the conventional longer expiry. The people in the non-sameday market are more professional and run more balanced books.

EquityIndex ATMSP500 DetailRussell DetailVIX DetailMetals

The lift in Gold vol was significant across the term. While the front almost always moves more, even the backmonths saw a healthy bid. Moreover, the move in price was in lock step with vol. In the front month, we can observe a call skew. It doesn't look like this move is exhausted.

Metals ATMGold DetailSilver DetailCopper DetailCopper Detail - LMEAgs

Corn was down in price, but vol skew moved towards the puts. Bean vol was off to the races in the front month. The weather will cause these contracts to fluctuate greatly, but the skew didn't change its orientation very much-maybe a slight increase in call skew. This should be contrasted with rough rice, which was off to the races.

Ags ATMCorn-EuropeRough RiceCorn DetailSoybean DetailAgs DetailsEnergy

Crude was bid over the entire price termstructure. Vol had a bid in the very front and back of the term. The back can be ignored because it is thinly traded. In the front, the skew neatly shifted upwards, with some small put skew increase. Vol has gone up at a 45 degree since the middle of July. Price had been going down the whole month, with the exception of the last day. Last month, we uttered the phrase, '...perhaps natty gas has found its legs...,' well after finding its legs it slipped on the soap in the shower. Vol was up. While for most products a vol of 65% is high, this is actually quite low for the product and the product's season. It would probably be plumbing the high 40s, were it not for the storm that struck and the one loitering in the Atlantic.

Energy ATMUS Natty Gas DetailWTI Crude DetailDetails EnergyAs always, we welcome you to visit our website and hope to help you manage risk!

CommodityVol.com is here to serve your needs around modeling, forecasting and understanding the market. If you have needs for commodity skews, parameterized surfaces (including stochastic volatility models), please do not hesitate to contact us! Contact Us